Let’s Discuss

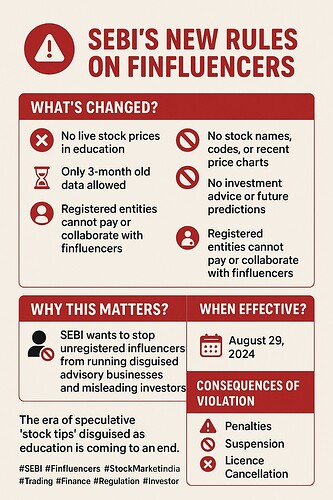

SEBI Tightens Grip on Finfluencers – No More Real-Time Tips Disguised as Education!

The Securities and Exchange Board of India (SEBI) has introduced strict new rules targeting financial influencers (finfluencers). In its latest circular, SEBI announced that stock market educators can now only use stock price data with a three-month lag, effectively banning the use of live prices in educational content.

This move is designed to stop finfluencers from offering disguised investment advice and speculative tips under the banner of “education.” Educators are prohibited from mentioning security names, codes, or recent price data that could imply advice or future predictions. They are also barred from making performance claims without SEBI’s approval.

Further, registered market entities cannot engage with finfluencers in any way involving payments or benefits. Any violations could result in penalties, suspension, or even cancellation of SEBI licences.

Effective August 29, 2024, these rules are set to significantly impact the finfluencer space, reshaping how financial education is delivered online.

#SEBI #Finfluencers #StockMarketIndia #Investing #Trading

Postmen to Double Up as Mutual Fund Distributors? ![]()

![]()

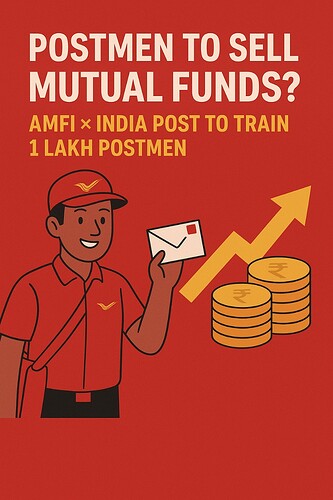

In a landmark move, the Association of Mutual Funds in India (AMFI) has partnered with India Post to train nearly 1 lakh postmen as mutual fund distributors. The initiative aims to double the investor base by expanding mutual fund penetration into rural and semi-urban areas, leveraging India Post’s vast 1.64 lakh+ branch network.

The pilot phase will begin in Bihar, Andhra Pradesh, Odisha, and Meghalaya, targeting 20,000 new distributors in the first year. AMFI Chief Executive Venkat N Chalasani stated that the goal is to ensure at least 10 distributors per district by year-end, and 20 by next year.

With mutual fund folios rising from 2.1 crore in 2019 to 5.6 crore today, India is witnessing a retail investment boom. Yet, with AUM at just 21% of GDP (vs. over 100% in developed economies), the growth potential remains massive.

By integrating financial services with postal services, this initiative could bridge the rural-urban investment gap and transform savings habits across India.

#MutualFunds #FinancialInclusion #InvestmentOpportunities #AMFI #InvestorEducation

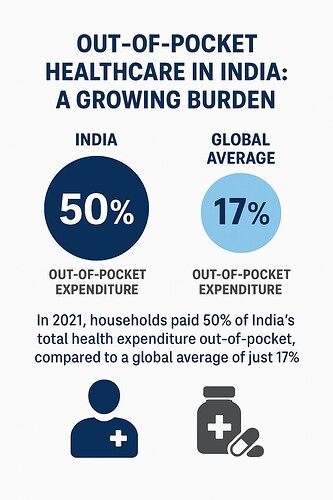

Out-of-Pocket Healthcare in India: A Growing Burden

India’s healthcare financing shows a stark vulnerability. In 2021, households paid 50% of the country’s total health expenditure out-of-pocket, compared to a global average of just 17%.

This heavy dependence leaves millions exposed to financial shocks. Families often delay treatment, borrow at high interest, or sell assets to cover medical bills. Each year, many are pushed below the poverty line due to healthcare costs.

The reasons are clear: low public health spending (around 2% of GDP), limited insurance penetration, and a dominant private sector where most care is expensive. In contrast, countries like the UK or Thailand have reduced household burdens through universal coverage and strong public systems.

For India, the way forward lies in higher public investment, wider insurance coverage, affordable private healthcare, and stronger primary care infrastructure.

Unless reforms are accelerated, healthcare will remain not just a service, but a financial risk for millions of Indian households.

#Healthcare #India #HealthExpenditure #PublicHealth #UniversalHealthCoverage

HNIs are shifting gears – chasing higher yields in commercial real estate

With debt mutual funds losing tax advantages, India’s wealthy investors are turning to commercial real estate (CRE) as a reliable avenue for both superior returns and wealth preservation.

Unlike residential properties that typically generate 2–3% rental yields, CRE assets like offices, warehouses, data centers, and hospitality are offering 6–10% yields. Beyond income, they provide inflation-hedged stability, making them a preferred choice for long-term portfolios.

Trends driving this shift include the rise of co-working spaces, ESG-certified assets, and Grade-A offices, backed by institutional investors and Alternate Investment Funds (AIFs). While risks like illiquidity and regulatory hurdles remain, the promise of steady cash flows and diversification outweighs the downsides for many HNIs.

As India’s investment landscape evolves, commercial real estate isn’t just about buildings—it’s about creating sustainable, high-yielding wealth engines.

#CommercialRealEstate #HNIs #WealthManagement #Investing #IndiaGrowth